The recent rate increases approved by the Florida Legislator is not enough for the ever-hungry insurance industry. The latest twist is a reevaluation of the hurricane risk zones in the entire nation.

Expected to be released in spring, the newly drawn risk map will increase rates and trigger policy cancellations. The new risk assessment originated from Risk Management Solutions (RSM) which is one of the leading producers of hurricane risk assessment software.

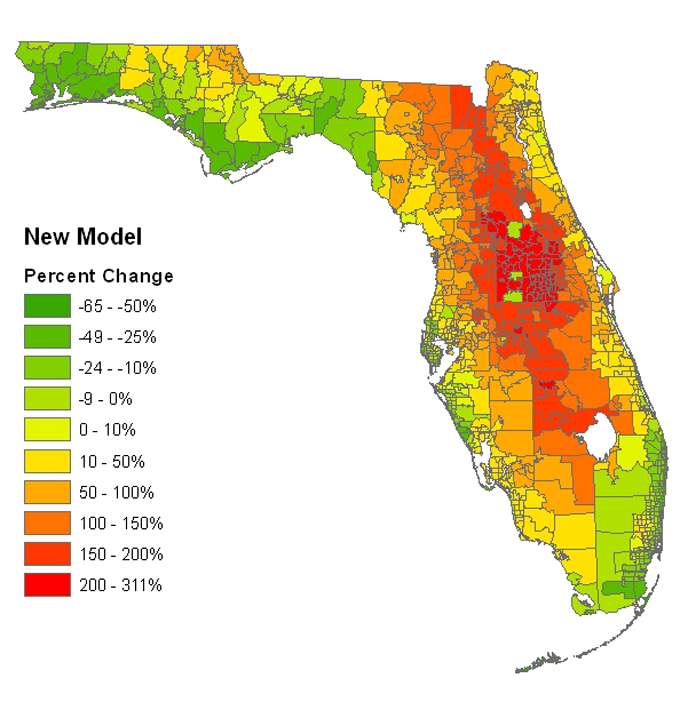

The new assessment can result in increases all over the nation and if it was believed to be safe “inland” this new assessment will put a dent into that thought. Based on recent storms which went deep into the mainland, RSM has concluded that storms have the potential to cause larger than expected damages to properties located inland.

After five years without a major storm hitting Florida, one would think the pockets of the insurance carriers are flowing over. But in the contrary, insurance carriers who recently applied for rate increases are complaining about constant losses in their books.

The question arises if the lawmakers really should have granted the rate increase; instead more transparency and accountability from the insurance companies should have been requested.

One thought on “After having $718 million approved in rate increases Florida insurers found an additional way to squeeze money from policyholders”

Comments are closed.