Reserve Studies Demystified Part 1 of 4

Reserve Studies are a myth for many homeowner’s and even the condo and HOA boards most often have no idea if their community needs a reserve study, has reserves in place and most important is appropriately funded.

This blog shall serve my clients as a glossary, explaining the most important aspects of a reserve study.

First of all, reserve studies are all about stewardship for your community.

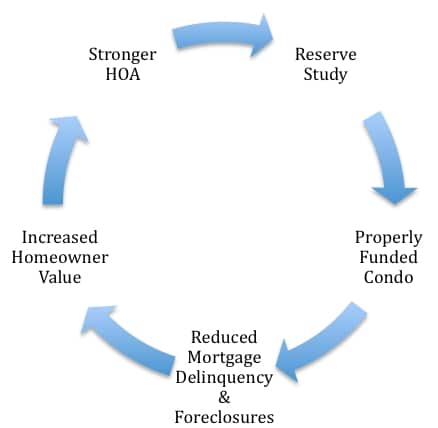

Reserves reduce the risk for special assessments and enhance property values. After the real estate crash in 2006, most banks do not lend money for potential condo or single-family home buyers, if the community is not adequately funded. Educated consumers will shy away from the purchase of a condo or home in a community which is in debt or has no reserves in place. Furthermore, studies have proven, that communities with reserves in place have a much better overall community appearance which in turn is appealing to homeowners and interested buyers alike.

Here is a list of components a reserve study should contain, based on CAI standards: (Community Associations Institute)

- Number of units of association

- Physical description and identification of the association

- Description of the current reserve status and methods of holding the reserves

- Fiscal Year the study is prepared

- Projection of stating reserve cash balance as of above date

- Recommended reserve contributions

- Projected reserve expenses (minimum 20 years, but better 30 years)

- Projected ending reserve fund balance (minimum 20 years, but better 30 years)

- Listing of all components in the reserve study

- Listing of all quantities of the components

- Listing of all useful life of each component

- Listing of remaining useful life of each component

- Listing of current RCV of each component

- General statement describing the methods (pooling or non-pooling)

- Funding models (fully funded, threshold funding, baseline funding)

- Identification of source for the replacement values

- Description of level of Reserve Study (full or update)

- Statement of assumptions for interest and inflation

In the next blog I will talk about “Straight Line” versus “Cash Flow”, two models, which are often interpreted wrong.

Stay tuned for the next blog in this series. If you do not want to miss it, please sign up to my feed in the Connect With Me section on the left or “Like” Staebler Appraisal and Consulting on Facebook and become part of my social community online.

If you have any question, I’d enjoy answering them~

Warmly,

Patricia Staebler, SRA

Thank you for the information Patricia. I will continue to try to follow you on Donna’s Linkedin page but would you also email me directly on the reserve information?

I would truly appreciate it. It is a subject which is difficult to grasp and follow in my HOA.

Thanks again!

Melissa

Hi Patricia,

I am glad to see reserves get some ink. Reserves are definately the forgotten grand child.

I thought I would send you a link to an article I wrote on Reserves which could be helpful with your series:

http://www.prasystem.com/en/blog/reserve-studies-why-the-confusion.html

If you need any assistance, I would more than happy to contribute.

Thanks,

Bill