Yes, it is that time of the year, when we get ready to face another hurricane season.

For that reason, I am taking off my appraiser hat today and will use my adjuster hat to give you some valuable tips in case your property will suffer from storm or flood damage.

First of all, mitigation, mitigation, mitigation. That is the most important item on your list. Prevent further damage by covering your roof, remove salvageable items from danger zones and secure the premises as best as possible. Make photos to proof to your insurance carrier that you took all precautions to improve the situation.

A good organized claim department will get you an adjuster contact within 24 hours and questions like tree removal and covering the roof should be discussed with the adjuster as soon as possible. Usually you can go ahead with emergency repairs to mitigate damages; make sure to keep your receipts and document what you have done with photos and maybe even a short narrative.

When it comes to estimates from contractors for permanent repairs, here is what you should request:

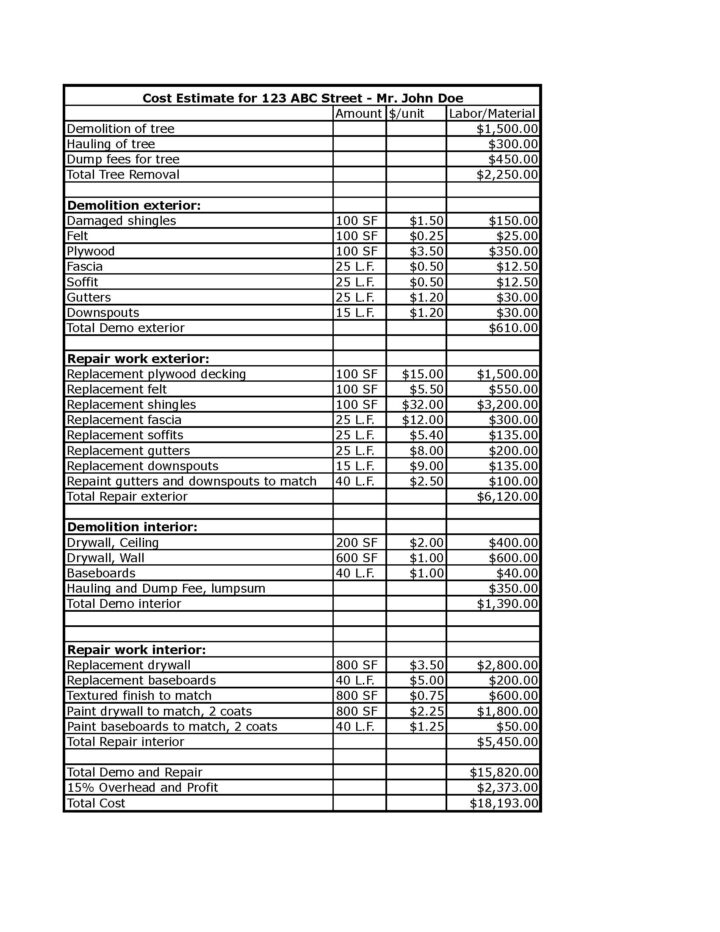

A line-item estimate.

I worked all four storms in 2004 and could not believe that most contractors did not understand what a line-item estimate is. Therefore, YOU need to know what it is, to be able to explain your contractor how to prepare it.

Let’s assume your roof is covered by a tree and you have a huge hole in your roof; the roof cover is damaged, the eaves are crushed, fascia and soffits are damaged and the interior ceiling has water damage.

Most of the times, a contractor will deliver an estimate which reads like this:

“Repair of roof, replace drywall, repaint ceiling, all necessary material and labor, $18,000.”

No insurance will accept an estimate like this. Therefore you need to educate your contractor and request the estimate as follows:

An estimate like this will be convincing and will help to compare bids from different contractors. (By the way, the costs are not actual costs, just examples). You should get at least three estimates from licensed, bonded and insured contractors. Verify that they are licensed by going to the Department of Business and Professional Regulation’s website, which has a site dedicated to license verification for all licensed professions in the State of Florida.

You also should request to see the adjuster’s estimate and compare it with the bids from the contractors. Your adjuster should sit down with you and explain how he came up with his cost estimate. He should have a sketch, pointing out the damages, a list with measurements, pictures and most likely a price list which contains similar items than the line-item estimate.

I hope none of us will have to ask for a line-item estimate this hurricane season, but just in case, you now have the right information to make life a little easier.

As always, thanks for your interest in my blog, if you have any questions, feel free to leave a comment and I will answer as quick as I can.

Hi Patricia,

Thank you so much for the tutorial on line item estimating. I am a contractor that does not do a lot of work through insurance companies, but usually through home owners. Needless to say, your first example is how I would usually write up an estimate with a little more detail like s.f, l.f., etc.

I currently have my Adjuster’s license and will be working catastrophe assignments. The line item estimate in your exmple is very good and I will use it to work with contractors and insurance companies.

Thanks again,

Lou